Inflation in the Post-Assad Era

- Issue 7

During the conflict, the Assad regime resorted to printing money as a common, though inflationary, method to finance persistent budget deficits. Initially the effects were subtle, with prices rising slowly. But as more currency flooded the market, with declining overall economic activity, inflation accelerated.

Following the collapse of the Syrian regime in December 2024, the country witnessed a drop in prices, with an annual deflation of 6.4% in January 2025, according to the Central Bank of Syria, followed by deflation of 15.2% in February 2025—down from an inflation rate of 109.5% in the same month of 2024. This dramatic reversal, driven by a series of actions by the Caretaker Government (CG), such as the abolition of ten import duties and removal of domestic barriers to trade, marked a step toward monetary stabilization efforts. Furthermore, the engagement of the new authorities with international financial institutions and the easing or suspension of Western sanctions brought renewed confidence, signaling the beginning of a new phase of reform that might have also contributed to the appreciation of the Syrian pound (SYP), making imports cheaper.

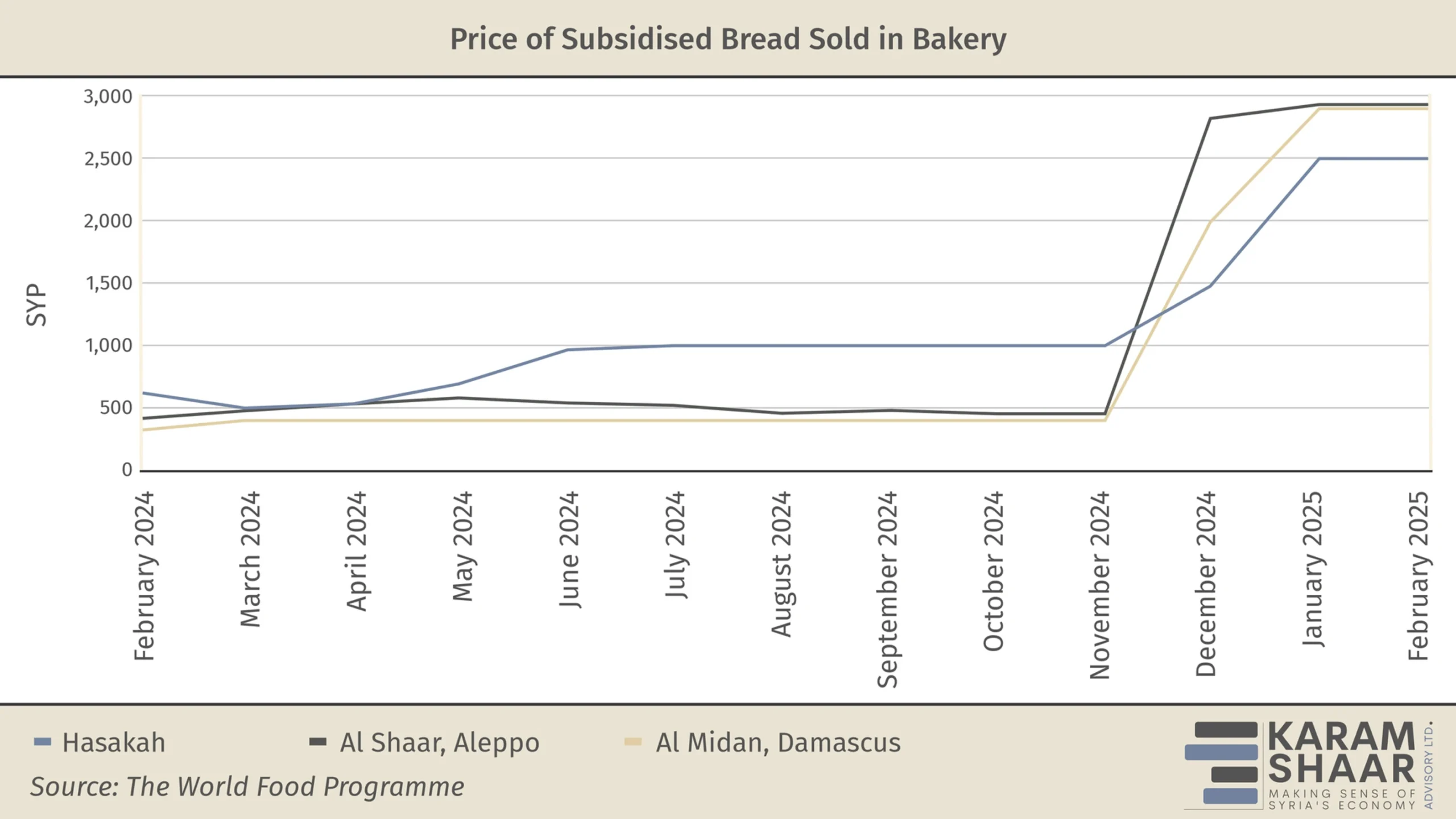

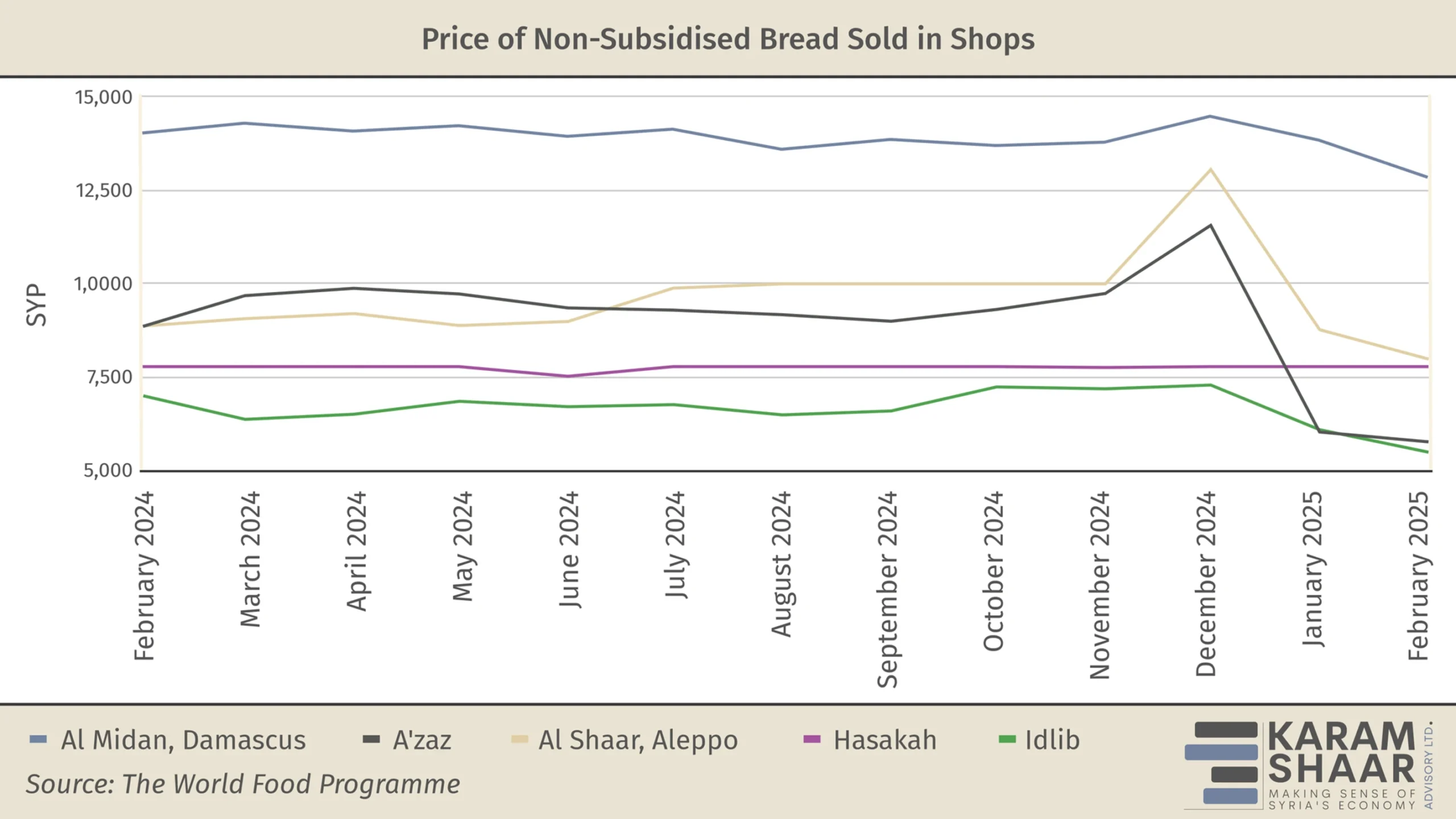

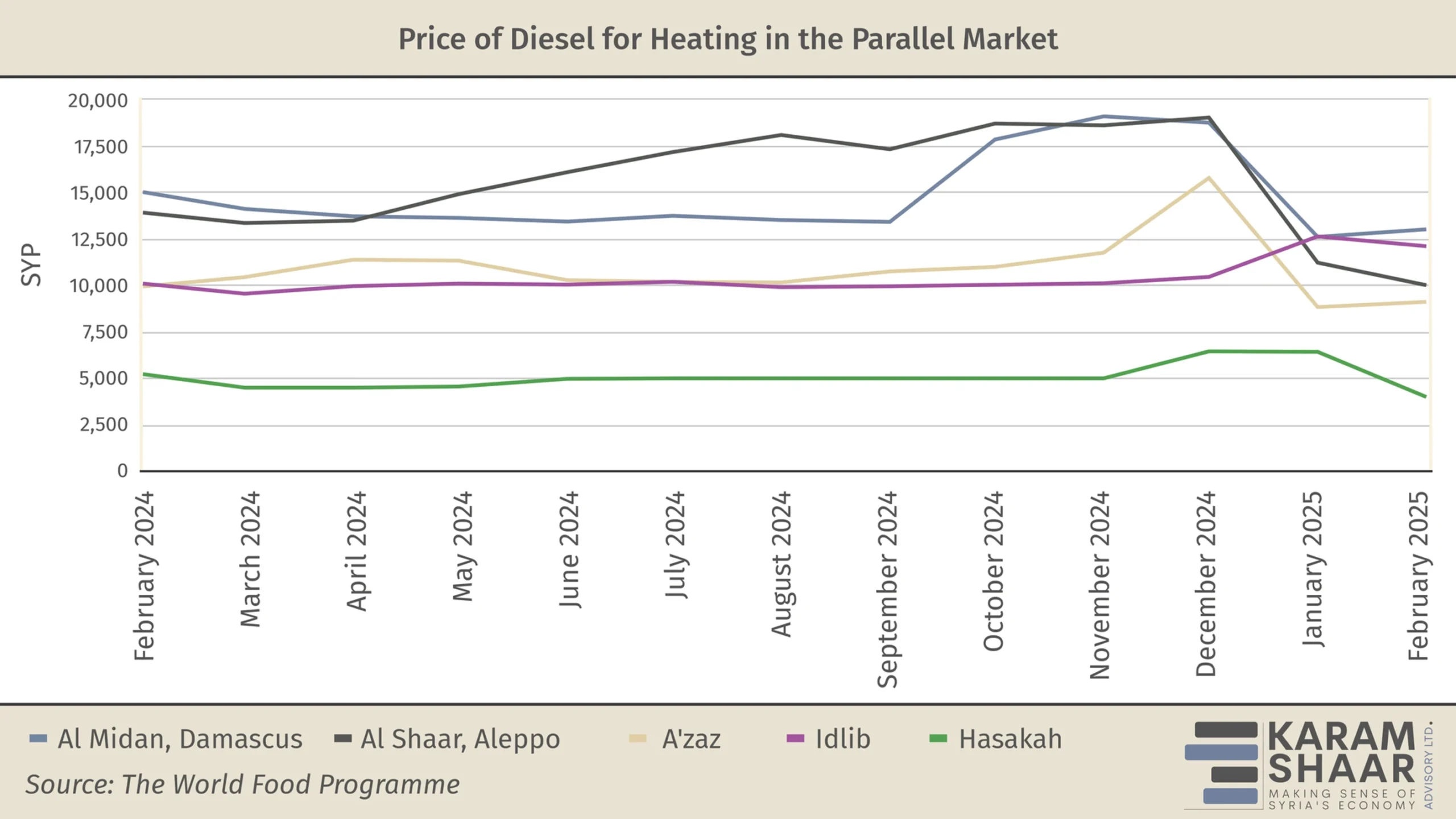

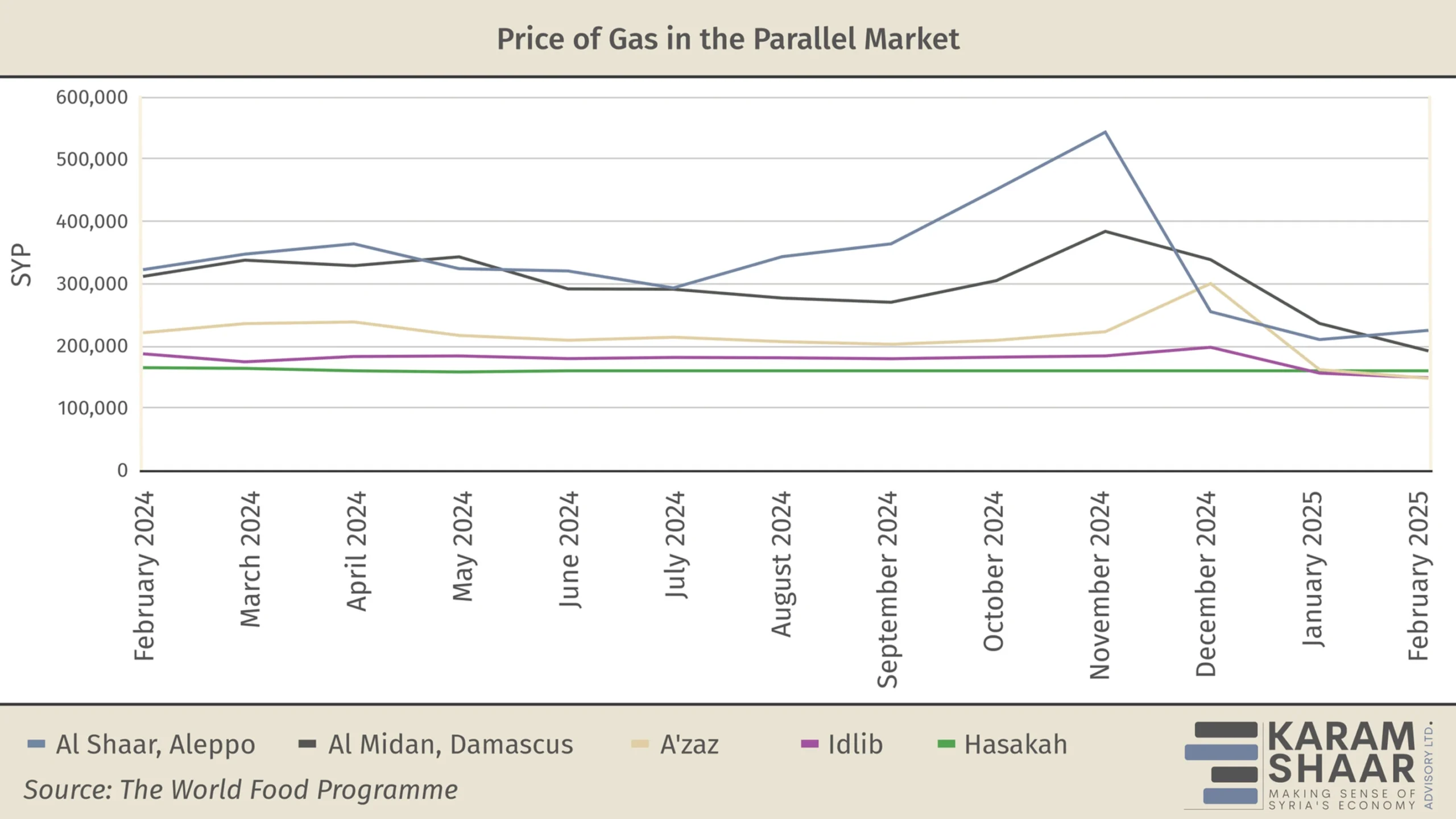

The decline in prices was preceded by short-lived inflation. According to the Syrian Center for Policy Research, Syria experienced a surge in consumer prices in December 2024 as the CG formed the new government, easing subsidies and removing price controls on essential goods like fuel, bread, and cooking gas. This increased transportation, electricity, and fuel costs, directly impacting production expenses. Inflation varied considerably across regions, with former regime-held areas—where subsidies existed—seeing inflation rates exceeding 22% month-over-month (M-o-M), while areas like Idlib and Raqqa saw slight price declines.

The World Food Programme also revealed that while the cost of the Minimum Expenditure Basket dropped by 15% in January relative to the previous month, trends across specific goods continue to vary. In January 2025, gas prices rose 38% month-over-month due to the removal of domestic gas subsidies, while bread prices increased 35% due to subsidy reductions. However, bread prices in shops decreased, and prices for vegetables, dairy, meat, and crops also fell.

The World Food Programme’s report also highlighted the disparity across provinces. The implementation of a unified customs tariff on 11 January 2025 had differing impacts across the country. In former Assad regime areas, it resulted in price reductions, while in the regions of Idlib and northwestern Aleppo, it caused sharp price increases—up to six times for certain goods. The variation was due to the fact that tariffs in opposition areas were lower than the new tariffs, while the opposite was the case in former regime areas.

The World Food Programme noted the reasons behind the recent overall decline in prices. Removal of military checkpoints, relaxation of import restrictions, the opening of the road between Aleppo and Idlib, and the abolition of the “Al Damimah” duty—an import duty introduced under Assad, intended to streamline customs processes and bolster the domestic economy—have all directly contributed to the recent decrease in prices.

Additionally, the appreciation of the SYP against the USD—strengthening in the parallel market from nearly 14,000 per USD before the military operation that toppled the regime in November 2024 to around 10,000 currently—is likely to continue to gradually translate into cheaper imports. However, this trend may prove short-lived. A significant portion of the SYP’s recent appreciation appears to result from stringent restrictions on money supply, particularly through limitations on cash withdrawals from banks and cross-account transfers. These measures are likely part of a broader effort to crack down on Assad-era cronies and seize their assets, with the restrictions on cash movement designed to minimize financial leakages before the process is completed. Nevertheless, as core economic fundamentals have not substantially improved, any easing of these restrictions is likely to trigger at least a partial rebound in the exchange rate, translating in due course into higher import prices, and higher inflation.